See All Photos Here

See Agenda and Sponsors

The Governor of Puerto Rico Pedro Pierluisi made the historic announcement at The Puerto Rico Symposium in Miami that Puerto Rico was officially out of bankruptcy. The message was well received by over 250 industry leaders from both the public and private sectors. The event was organized by The Urban Land Institute South East Florida / Caribbean and The Puerto Rico Builders Association.

The Symposium was kicked-off by Scott McLaren, President ULI SE Florida / Caribbean. Scott spoke about the longstanding relationship and collaboration between ULI and the Puerto Rico Builders Association. He highlighted the work on the ULI National Advisory Services Panel on social, economic, and physical resilience in Toa Baja, Puerto Rico. https://seflorida.uli.org/toa-baja-puerto-rico-panel/

Scott Maclaren finished his remarks by recognizing Vanessa de Mari, the new President of the Puerto Rico Builders Association and the first women president in the organization’s 70 year history. The Symposium was dedicated to this historic accomplishment. In attendance were some of Puerto Rico’s top government leaders. This included the Honorable Pedro Pierluisi, Governor of Puerto Rico, Manuel Laboy, COR3 Executive Director, Maretzie Diaz, Deputy Director PR Housing Department CDBG-DR, Natalia I. Zequeira, Commissioner of Financial Institutions, and in attendance, the Secretary of Housing of Puerto Rico, William Rodríguez Rodríguez. The keynote address by the Honorable Pedro Pierluisi, Governor of Puerto Rico’s highlighted the island’s economic accomplishments, the end of Puerto Rico’s population exodus, and the conclusion of the bankruptcy which was officially announced the day of the Symposium.

In the private sector, Ricardo Alvarez-Diaz, CEO, Alvarez-Diaz & Villalon discussed some of progress of the island’s rebuilding after the 2017 hurricanes Irma and Maria. The reconstruction of the island was a constant theme throughout the day with specific examples of over 900 started projects.

The first panel, “Why Puerto Rico: Stories of Success, was a testament to the resiliency of the development community. Moderated by Andrew Carlson, SVP Country Manager, of JLL the discussion highlighted the historic growth of the island’s hospitality sector with the construction and/or renovation of over 3,000 new room keys from El Conquistador, Grand Reserve (formerly known as Coco Beach), Sheraton, AC , and many others. The panel included Federico Sanchez, President & CEO, Interlink Group.

Dan Kodsi, CEO, Royal Palm Companies, Rafael E. Rojo, President & CEO, VRM Companies. Also in attendance was Brad Dean, CEO, Discover Puerto Rico who highlighted the island’s impressive tourism growth (ADR and occupancy rates) during the Covid 19 pandemic and new expansion of tourism throughout all U.S. feeder markets.

As Puerto Rico seeks to build back its tourism and other industries, the financial sector will invariably play a major role. One of the goals of the Puerto Rico Symposium was to facilitate the conversation of growth in both traditional banking as well as new Fintech, IFEs, and other debt/equity players. Natalia I. Zequeira, Commissioner of Financial Institutions, explained the ease of regulations and process for new financial institutions as Puerto Rico shares many of the same regulations of the U.S. states on the mainland. Ms. Zequeira also mentioned that International Financial Entities (IFE) can now participate in special opportunity projects.

https://www.investpr.org/key-sectors/finance-and-insurance/

Michael McDonnell, Executive Vice President, First Bank, that recently re-opened its construction division, was bullish on the island’s economic prospects and announced that the Puerto Rico will achieve positive economic growth (GDP) this year– something it has not done in over a decade. Banesco USA announced the U.S. Department of the Treasury, will invest more than $8.7 billion through ECIP in institutions across the country – Banesco USA is the only bank recipient located in Florida or Puerto Rico.

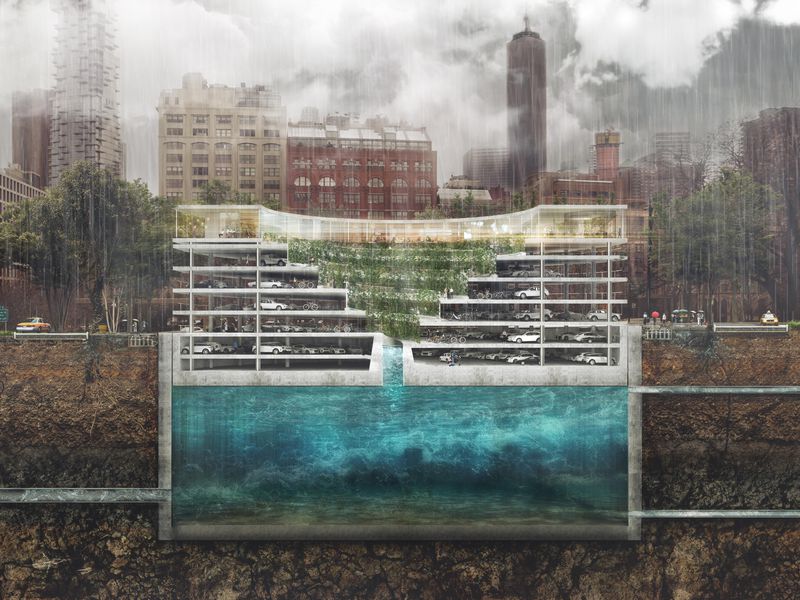

Over the last few years, we have all hear about the 80 billion dollars of relief aid that has been allocated to Puerto Rico and is coming. In the “Myth versus Reality panel: Federal Funding Opportunities on The Island,” moderator Ella Woger Nieves of Invest Puerto Rico helped lift-up the proverbial transparency veil. Manuel Laboy, the COR3 Executive Director spoke with detailed facts of the funding by agency with FEMA authorizing 5 billion for temporary work, 21 Billion for 9,000 permanent projects and 800 that are currently under construction today. He also discussed the next wave of over 900 projects that are currently under engineering and design. Much of this work will be channeled through CDBG-DR and the PR Housing Department. Maretzie Diaz, the Deputy Director PR Housing Department, explained the process for companies wanting to participate in the island’s rebuilding of housing and infrastructure. Mahdu Beriwal, Owner/founder of EIM provided first-hand knowledge of the rebuilding work in Puerto Rico.

Keynote Speaker Pamela Pautenade, Ex. Deputy Secretary of HUD, was also on hand to share her experiences about the collaboration with the Puerto Rico Builders Association during the 2017 hurricanes crisis. In a moving conversation with Ricardo Alvarez-Diaz, Mrs. Pautenade explained the dedication of the island’s public and private sectors and dispelled any rumors about misuse of relief funds.

Puerto Rico, like much of the Caribbean is in the process of bouncing back from the Covid 19 pandemic. Adam Greenfader, who chairs the ULI Caribbean Council had a high level sit down conversation with keynote Speaker Andrew Farkas, CEO Island Capital Group. The conversation was focused on social equity and specifically what role the financial sector has in supporting the region with a particular focus on sustainability, ESG, and helping economic migrants return back to their island homes.

In the last few years Puerto Rico has become known as blockchain capital of the world. While thousands of tech savvy individuals have moved to the island to take advantage of federal tax incentives they have inadvertently created a new economic driver for the Puerto Rico.

In our “Fintech & Financial Innovation panel in Puerto Rico, Moderator Nathan Whigham, Founder & President, EN Capital discussed the growth of this huge industry. Rodrick Miller, CEO, Invest Puerto Rico, explained what his group is doing to change the paradigm in Puerto Rico from selling tax incentives to focusing on the island’s quality of labor, education system, and proficiency in bio science and other innovations. Stephen Inglis, CEO, Importal explained his new portal to monetize tax credits and Yael Tamar, CEO & Co-founder, SolidBlock explained how her company is integrating real estate and blockchain.

After a marathon day of conversation it was amazing to see the room still full for our last panel “Growth Industries and Tax Incentives” moderated by Carla Campos and an all-star team including Jorge Ruiz Montilla, McConnel Valdez, Francisco Luis, of Kevane Grant Thornton and Rogelio “Roy” Carrasquillo, of the Carrasquillo Law Group. In this panel, specific programs like the Tourism Tax Incentive were explained in detail and there was robust conversation regarding how these incentives have created new jobs in manufacturing, life sciences, construction, and agro-science.

On behalf of all of us at the Puerto Rico Builders Association and The Urban Land Institute SE Florida/ Caribbean, thank you to all of the people and sponsors that made The Puerto Rico Symposium possible. We are all hopeful that together both the public and private sector can create long lasting sustainable economic growth.

For more information about investing in Puerto Rico visit our web site or contact us.