Coming Back with FirstCaribbean Investment Bank

Are Hotels Coming Back to The Caribbean?

The State of Tourism in Latin America and Caribbean with IDB Invest

Caribbean Conversations with Rogerio Basso

The Elimination of Section 936

Historic Times

Dear Clients and Friends,

We are living in historic times, challenges…and opportunities. While we are sure you have received many notes like this, we wanted to share that AG&T remains healthy and available to help or to listen when and if the need arises. We intend to respect social distancing yet will be steadfast to remain virtually close. We want to invite you to our webinar where we will expand on the notes below. Keep an eye out for an invitation to the virtual seminar coming your way soon.

How Are We Making Business Decisions?

This is new territory for all of us. While we do not possess the proverbial “crystal ball”, our world view, and the planning framework we are suggesting to our clients, is that while this interruption is likely to be quite profound and deeply impactful, it should prove to have been temporary. Our planning framework contemplates a recovery of the US economy during the second half of 2020. Delaying projects and investments already in the pipeline should be carefully considered, and everyone should keep a keen eye for opportunities driven by distress. We are already seeing some signs of distress, and expect much more in the weeks to come. AG&T is not fundamentally altering our long-range plans, our team structure, or making other rash changes.

We revisit this outlook weekly, and will communicate updates as we go along. We are participating fully in global efforts to “flatten the curve” in terms of the virus’ spread. AG&T is fortunate that our travel schedules and cross office staffing processes – in place for years – have made it relatively easy for us to transition further to a virtual workplace. Every AG&T team member has full technological and practical abilities to work remotely and this transition has been relatively seamless for us.

What Are We Working On?

AG&T remains fully engaged and doing value add work for our clients. This includes:

Management Consulting. One of the hallmarks of AG&T’s strategy planning work is to achieve maximum value and mitigating risk at all stages of the development life cycle. We are helping our clients implement and adjust their strategy plans, understand changing market conditions, and helping firms think through cash management and risk mitigation practices. Fortunately, most of our clients in the middle of strategy planning or development consulting engagements have chosen to continue working on them, which we believe is prudent.

Acquisition and Disposition Services. Our large institutional clients are asking us to review and revise investment velocity, provide real time feedback on development risks, highest and best use valuations, and evaluate viable capital stacks for acquisitions. As you would expect, many large investors are thinking through buy opportunities that may emerge as the markets normalize and how they might respond to them.

Market Research. Many of our clients understand that to be in business in the spring and summer, or when transaction activity resumes, they will need up-to-date market research, and an even more cogent formal discussion of the market rationale for a proposed investment or development, including a discussion of the impact and long-term effects of the interruption and/or the virus.

How Are We Living Out Core Values?

Tough times reveal the strength of a company. These are some of the ways we are putting our values into action:

1. Putting Families First.

Above all else, we are doing all that we can to support the health and emotional well-being of our team and their loved ones. This requires a lot of work and flexibility, but to date we are heartened to see the enhanced team spirit and discipline of mutual support that we believe is the hallmark of our culture.

2. Being Generous.

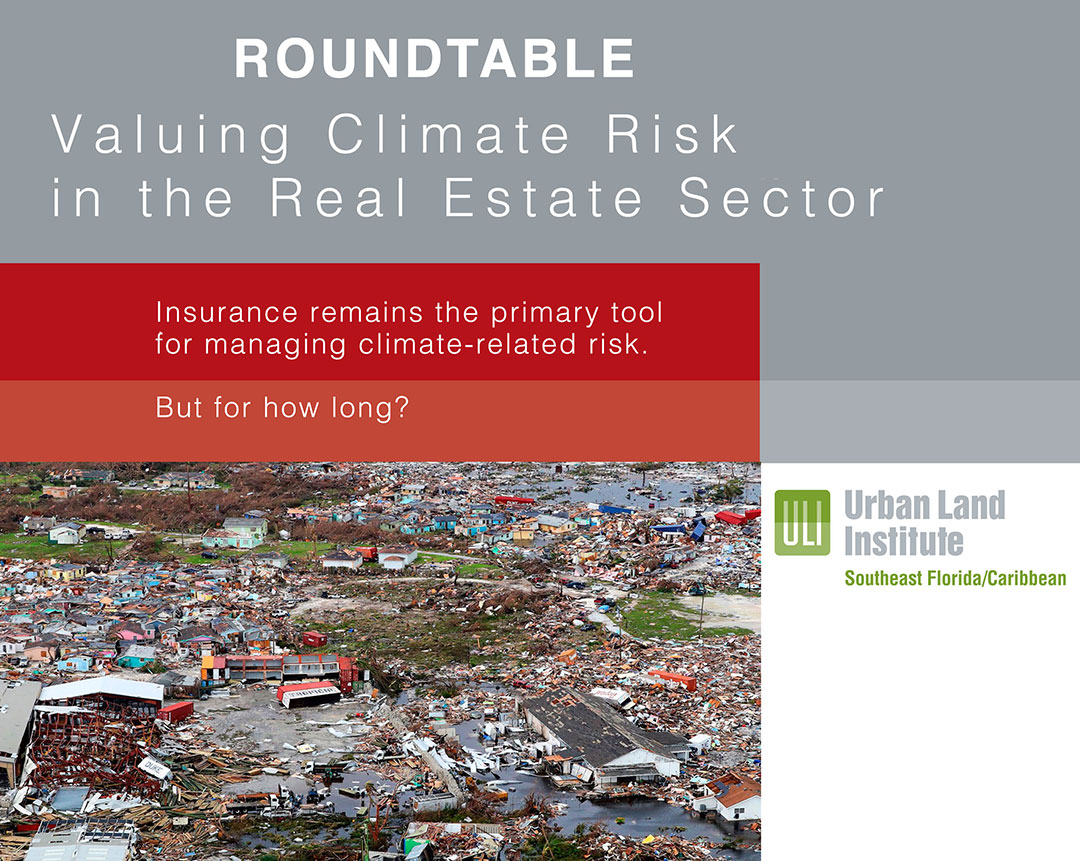

AG&T is committed to a belief that we can be a force for good at least in small ways. We realize that the impact of this disruption will be felt unequally across our communities; especially in small islands where medical systems are poorly funded. As one example, AG&T’s mission is to make a meaningful difference in the practice and policy of sustainable development. We will continue to work in facilitating the construction of resilient communities, sustainable hotels, and promoting thought leadership with our network of top professionals worldwide.

3. Help Where We Can.

Above all else we will honor our commitment to help our clients whenever and however we can, and to honor those relationship as long-lasting bonds based on trust. When our phones ring, we answer. We are available for guidance, for ideas, or just to listen.

Expect to hear from us in the days and weeks to come. And expect to be business partners with us for years to come after this. We hope for a speedy recovery from the challenges at hand, and are confident that our team, our friends and our clients, collectively the Best Minds in Real Estate, will be bold in charting the way forward. We may not know exactly what the journey holds, but we will come out on the other side. As the Coronavirus is novel, so will come creative solutions, new approaches and innovative ways of surviving together. For tomorrow will return to normal someday.

As always, we welcome your thoughts and comments, and wish you and yours all the very best. Stay healthy, safe, and positive.