Join an all-star panel to discuss “Are Hotels Coming Back to the Caribbean?” : a ULI discussion on The State of the Caribbean Hotel Market.

Hear from leading Caribbean hospitality professionals about what’s happening from operations, investing, transactions, and lending perspectives.

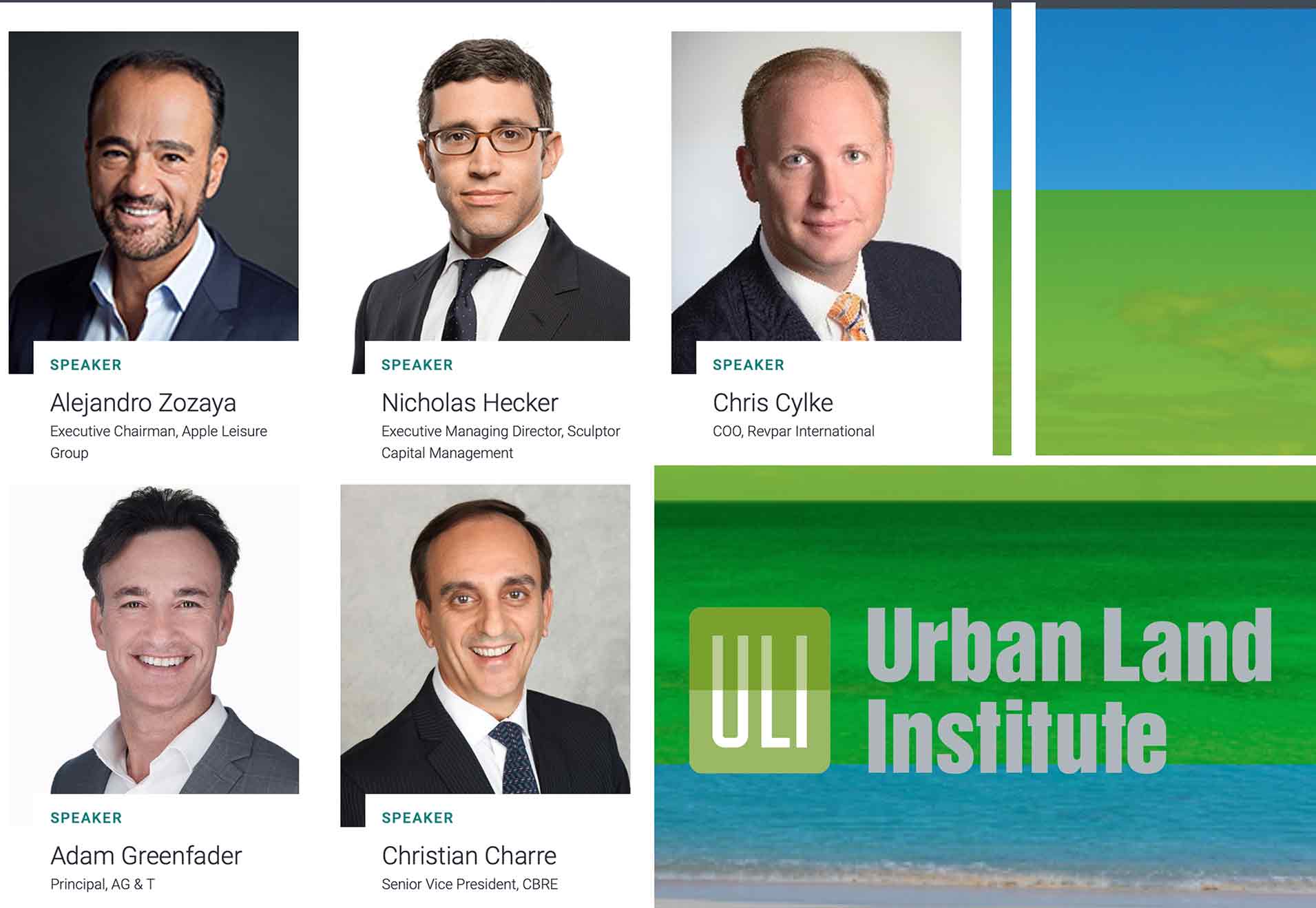

Managing Partner AG&T

Executive Chairman, Apple Leisure Group

Senior Vice President, CBRE Hotels

COO, REVPAR International, Inc.

Executive Managing Director/Chief Investment Officer,

Sculptor Real Estate

Three questions answered:

1. What hotel transactions are happening today?

2. Is the hotel market going to undergo a series of defaults, acquisitions, and repurposing?

3. What operational changes is the hospitality industry doing to successfully come back on line?