Reconstruction Conference Puerto Rico

October 5, 2018,

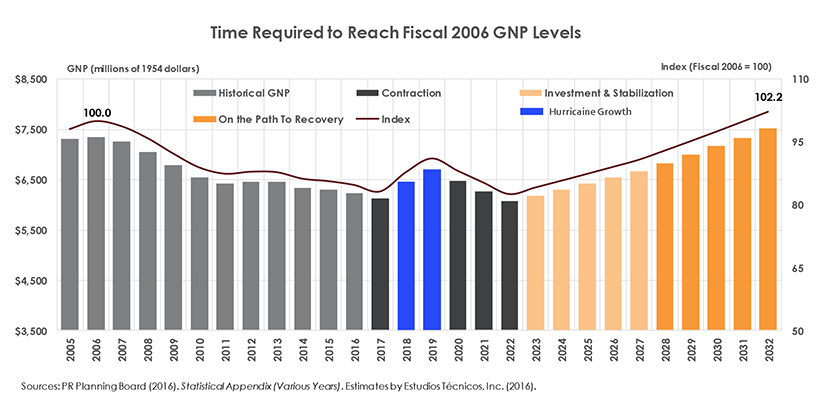

As of today, supplemental appropriations for disaster relief add up to a total of $136.1 billion, The Center for Puerto Rican Studies at Hunter College, CUNY, the UPR Graduate School of Planning will convene an event to discuss these opportunities. Currently, an estimated $30 billion of these funds has been distributed, allocated, or obligated for recovery efforts in Puerto Rico. In addition to funds earmarked for disaster relief, there are other federal programs that provide financial support to economic development and could be combined with disaster relief funding to make feasible economic development projects.

Core federal programs supporting economic recovery in Puerto Rico after the catastrophic impact of Hurricanes Irma and Maria include:

1. CDBG-DR: The Community Development Block Grant (CDBG-DR) Program may fund a broad range of recovery activities. As of today, $1.5 billion have been allocated as part of the first CDBG-DR grant. The period for public comments to the CDBG-DR Action Plan ended on May 25, 2018 and HUD will respond to public comments by August 1, 2018. A similar process will take place for the other CDBG-DR funds awarded to Puerto Rico totaling $18 billion.

2 Opportunity Zone: Puerto Rico has been designated as an opportunity zone. Investor in Qualified opportunity funds intended to target economic development and job creation in poverty areas are offered partial exemption for short and long-term capital gains taxes, full exemption of all capital gains if investments are maintained for 10 years.

3. HubZones: The HUBZone program, run by the Small Business Administration, allows small businesses to obtain government contracts without the “full and open competition” normally required, gives preferential consideration to those businesses in full and open competition and makes businesses eligible to compete for set-aside contracts. On a per capita basis, the total dollar value of federal contracts performed in Puerto Rico is less than in any U.S. jurisdiction, other than American Samoa. Additionally, 6 out of 10 federal contracts performed in Puerto Rico are awarded to firms outside of Puerto Rico rather than local businesses.

4. Low Income Housing Tax Credits (LIHTC): The LIHTC program is one of the largest sources of new affordable housing in the United States. The program provides tax incentives to encourage private and nonprofit developers to create affordable housing projects. The Puerto Rico Housing Finance Authority (PRHFA) announced a total estimated annual allocation for 2018 to 2020 of $16,038,934 with set-asides of $2,353,698 for nonprofit and $13,685,035 for other projects.

5. New Markets Tax Credit (NMTC): The NMTC program incentivizes community development through the use of tax credits to attract private investment to qualified low-income communities. Financial intermediaries such as banks, developers, and local governments can qualify to become Community Development Entities (CDE). NMTC investors receive a tax credit against their federal income tax in exchange for making an equity investment in a CDE. 91% of Puerto Rico’s census tracts are NMTC eligible, and 44% of those are also designated “Hot Zones.” However, the program is not heavily utilized in Puerto Rico. Prior to 2016, NMTC investment in Puerto Rico totaled around $110 million dollars, approximately .3% of the total NMTC investment.

6. USDA Rural Development Programs: The US Department of Agriculture offers several programs to facilitate and fund development of rural areas. Rural communities are often affected by geographic isolation, low-density settlement, and limited investment activity from the private sector. The USDA offers grants and loans, and these could be combined with other federal programs to make rural housing and community development programs financially feasible. USDA programs are underutilized in Puerto Rico.

![Microsoft Word - Draft of Cost of Maria (rev)[1].docx](https://agandt.com/wp-content/uploads/2022/05/Funding-Sourcesi-1-1.jpg)

![Microsoft Word - Draft of Cost of Maria (rev)[1].docx](https://agandt.com/wp-content/uploads/2022/05/damaged-homesi.jpg)

![Microsoft Word - Draft of Cost of Maria (rev)[1].docx](https://agandt.com/wp-content/uploads/2022/05/Time-to-Recoveryi.jpg)